The article Risk and Diversification of Nonprofit Revenue Portfolios: Applying Modern Portfolio Theory to Nonprofit Revenue Management by Heng Qu offers a groundbreaking perspective on nonprofit revenue management. This blog aims to focus on the implications for evaluation practice and how these insights can be used to diversify funding sources.

Understanding the Core Concept: Modern Portfolio Theory (MPT)

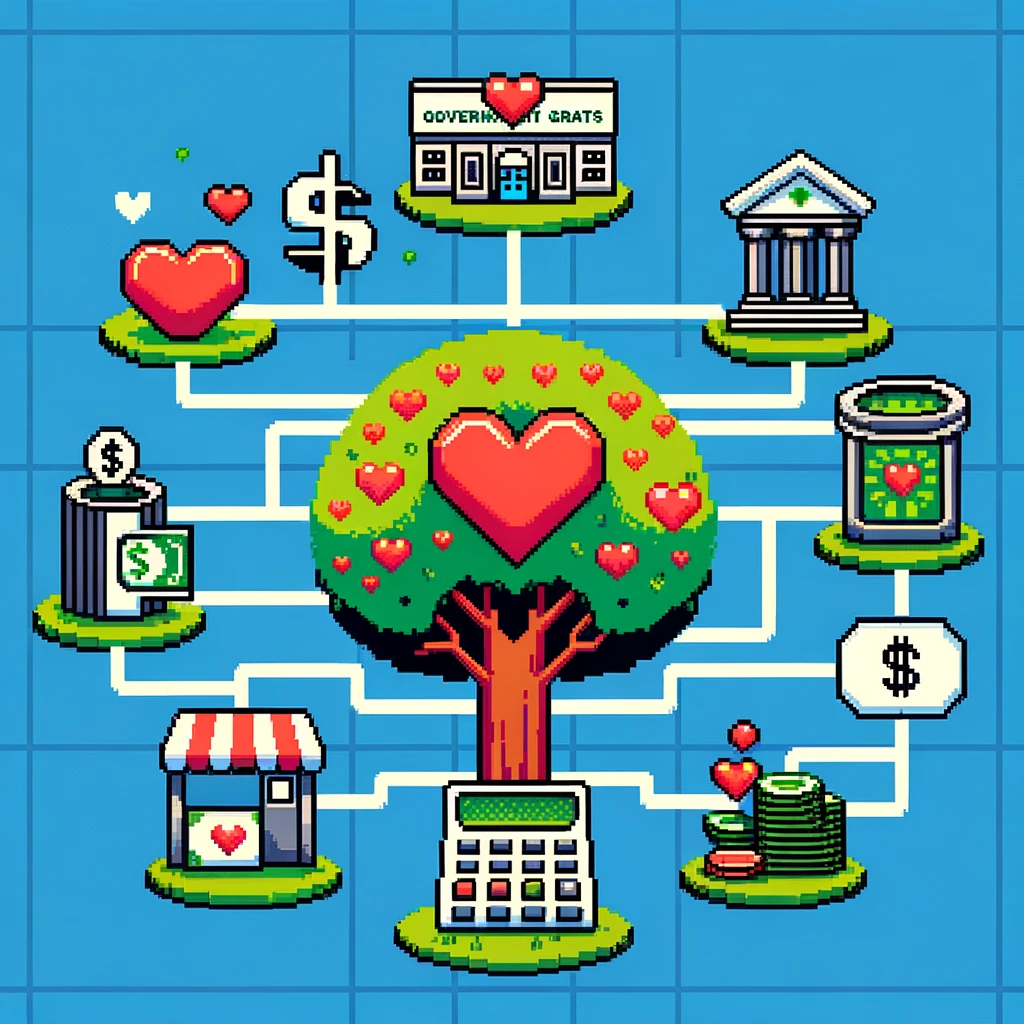

MPT, a staple in financial management, is ingeniously applied to the nonprofit sector in this study. This theory suggests that diversifying investments can reduce risk without sacrificing returns. Qu translates this into the nonprofit context, proposing that a diverse mix of revenue sources can similarly balance risk and stability in nonprofit income.

Key Findings: Diversification in Nonprofit Revenue

Qu’s research reveals a nuanced reality: while diversifying revenue sources is generally recommended, the impact varies based on an organization’s primary funding structure. Interestingly, nonprofits heavily reliant on commercial income tend to have lower revenue portfolio risk with greater revenue concentration. This contrasts with organizations dependent on donations, where higher revenue concentration links to higher portfolio risk.

Implications for Nonprofit Management

- Strategic Diversification: Nonprofits should not just diversify for the sake of it. The study encourages a strategic approach, analyzing how different revenue sources interact and impact overall financial health.

- Tailored Revenue Strategies: The ‘one-size-fits-all’ strategy is ineffective. This deserves to be repeated. It’s ineffective. Each nonprofit must understand its unique revenue structure and adapt its strategy accordingly.

- Evaluation Practices: Regular assessment of revenue sources and their risk-return profile is crucial. This dynamic approach ensures that organizations can adapt to changing economic climates.

Practical Use: Diversifying Your Funding

- Assess Your Portfolio: Understand your current revenue mix. Are you overly dependent on a single source? How does each stream contribute to your overall financial health?

- Explore New Avenues: If you’re heavily reliant on donations, consider exploring government grants or commercial activities and vice versa.

- Monitor and Adapt: The economic landscape is ever-changing. Regularly review your revenue strategies to ensure they align with your risk tolerance and financial goals.

Conclusion

Qu’s work is a vital resource for nonprofits navigating the complex world of revenue management. It goes beyond conventional wisdom, offering a scientifically backed approach to achieving financial stability and sustainability. This study is not just an academic exploration; it’s a practical guide for every nonprofit seeking to thrive in an unpredictable financial environment.

Diversify and Maximize Your Own Resouces!

Join a community of nonprofit leaders dedicated to financial sustainability! Nonprofit Revenue Readiness Meter and contribute to a larger effort to understand and improve nonprofit funding strategies. Your input is invaluable in shaping a future where nonprofits thrive. Let’s collaborate to uncover the best funding solutions for organizations like yours. Start the survey now